I’ve been rather offline for most of January, and I thought you wouldn’t notice. But, a bunch of you – including people I barely know — have been dropping emails or near strangers stopping me at coffee shops, “What’s up?” and, “Why haven’t I written for Harvard lately”. Well it’s nice to be missed, and I’ll share soon what I’ve been up to soon. Until then, let me share some good reading …

Four Must-Reads:

Banks: You Can Take and Not Give, But Not Forever

“Why are the banks paying only 0.4 percent interest on a savings account if they can afford to open offices on every other block in Greenwich Village? The other day I was catching up on balancing my account and realized that, for the last six months, I had earned about $4 in interest but had been charged $35 a month for service.”

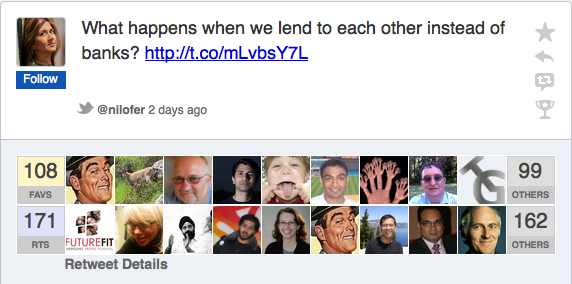

This essay raises a real issue. Much of January, I’ve been writing what looks to be a 9-part essay series on the implications to traditional institutions when they face the social era. Which caused me to ask the Twitter community: “What happens when we lend to each other instead of banks?”

The banking industry should worry. So should just about every institution that hasn’t figured out the capability to exercise collaborative power.

Apple & The Message Consumers Will Send.

“On the other side of the world, a young girl is also swiping those screens. In fact, every day, during her 12+ hour shifts, six days a week, she repetitively swipes tens of thousands of them. She spends those hours inhaling n-hexane, a potent neurotoxin used to clean iPhone glass, because it dries a few seconds faster than a safe alternative. After just a few years on the line, she will be fired because the neurological damage from the n-hexane and the repetitive stress injuries to her wrists and hands make her unable to continue performing up to standard.”

Do you have any doubt that suppliers would change EVERYTHING tomorrow if Apple told them to? There are clearly enough profit margins available to fix this issue. Apple is the richest company in the world, posting profits for last quarter of 42.4% last week. Now, the question is whether average consumers (including yourself) care. Sign the petition or learn more here:

Essay: The Trust Paradox

A fellow thinker, John Hagel, has written a thoughtful piece about what once did, and what will define trust.

Trust used to be largely backward looking – did the person or the institution have a track record indicating that they had the necessary skills to deliver results? In these more uncertain times where skills have a depreciating half-life, the focus shifts to a forward looking question – does the person or institution have the values and disposition required to learn faster by working together in times of increasing uncertainty and rapid change? Can they be relied upon even though their existing skills are increasingly challenged and undermined by rapid change?

The implications for individuals and organizations are huge. Whole essay worth reading here.

Amazon, Analysts & Why The Sky Is Not Falling

Amazon has become a real company to watch, not only because it continues to morph from a retailer to a platform player but because they seem to do what is right by the company without regard to the street / analysts / circus. If you read some of the recent press, it sounded like gloom and doom. The universal point of view was that Amazon was making all these investments, which weren’t paying off. But taking a look at the detail didn’t suggest that. While the top-line went down, the bottom line went up. I had been thinking of how and why the analysts can be so easily distracted when I discovered this post. The lesson is two-fold: (A) Amazon is fearless in how it chooses to reinvent, and (B) the metrics used by Wall Street are not a solid indication of value created. Many, many key metrics are missing.

Signed the apple petition. Thanks for that, Nilofer! Beyond absurd that such a wildly successful company has people literally dropping dead from exhaustion to make their products.